We have been hearing about GST since April 2015. A year has passed and there are still things that aren’t clear about GST where they are taxable or simply out-of-scope.

GST shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person. GST is also charged on the importation of goods and services. Malaysia Customs

One thing that is clear is that for any residential property, GST is not applicable. Though residential property is not subjected to GST but how about a residential property that being put for auction? Before we dive into auction property, it is worthwhile to understand the basics of GST.

Below is an article (with permission) written by Alan Poon titled GST AND AUCTION PROPERTIES; Is GST applicable to auction properties? Which I think it is a well-written article about GST on auction properties.

Alan Poon is a real asset value investor, who focuses on tangible and undervalued assets, specifically real estate, as his choice of investments. He founded Superior Wealth Mastery, an organization dedicated to the mastery of wealth education as the cornerstone of success and happiness in life.

UNDERSTANDING THE LAW

The Goods and Services Tax (GST) is a multi-stage tax on domestic consumption. Hence it is charged on all taxable supplies of goods and services, except those specifically exempted. In the context of real estate, for example, residential properties are GST-exempted, whereas commercial and industrial units are those where GST is applicable.

Anyone who is registered under the Goods and Services Tax Act 2014 is known as a ‘registered person’ and is required to charge GST (output tax) on all taxable supply of goods and services made to his customers. He is allowed to claim back any GST incurred on his purchases (input tax) which are inputs to his business. Therefore, the tax itself is not a cost to the intermediaries and does not appear as an expense item in their financial statements.

AUCTION PROPERTY LANDSCAPE

In the property auction process, an auctioneer is a person who acts as an agent or intermediary to sell goods in the form of properties to the highest bidder. Auctioneers are either individuals or a company that receives a commission or fee for carrying out the auction and they are regulated by different state laws and authorities. Besides providing an auctioning service for their clientele, an auctioneer also charges for services such as advertising, assessment, consultation on price and other miscellaneous fees, which are incidental in nature. These are considered taxable supplies too, and he is required to register as a GST-registered person, provided he has achieved the threshold required in total turnover in his auction business. Now let’s look at who gets affected in the supply chain process of property auctions.

SUPPLY CHAIN STAKEHOLDERS

Owner

A person who owns the property that was put up for sale via auction. Also called the principal.

Financier

An institution such as bank that has provided loan financing or credit to a buyer for their purchase of property. This party usually got involved due to default payment from the buyer in their scheduled repayment. Subsequently, the property will be repossessed and put up for auction in order to recover the loan.

Auctioneer

A person or company acting as an agent to dispose the repossessed property on behalf of an owner or financier via auction.

Bidder

A person who bids for property in an auction. A auction process and shall be subject to GST, chargeable to them as output tax by the owner through the auctioneer depending on whether the principal is a GST-registered person or not.

OWNERSHIP AND TAX LIABILITY

Property sold under auction does not belong to the auctioneer as they merely act as an agent for the financier and owner. However, the liability is on the auctioneer to account for tax if the auctioned property belongs to a taxable person.

Output Taxes

Whether an auctioned property is to be charged with output tax wholly depends on the owner’s status under GST. An owner who is registered with GST shall have his or her property auctioned with output taxes. If the owner is not a taxable person, there cannot be output tax charged to the auctioned unit. As for the services rendered during an auction, investors and homebuyers need to be aware that the cost of acquiring an auction unit also relies on the GST status of the auctioneer, since a registered auctioneer will be able to charge output taxes for his services. These include commissions or fees that were charged to the owner or financier as part of the overall cost of the auctioned unit. Successful bidders are advised to bear this in mind as well. It is important to note here that for an auctioneer who is not a taxable person, commissions and fees charged by the auctioneer to the owner or financier are not subject to taxes.

Input Taxes

While this may not affect the bidders very much, input taxes do have bearing on the auctioneer who cannot claim input tax credit on properties that were auctioned off as the input tax credit would have been claimed by the owner at the time he acquired the property.

Input taxes can be claimed by the auctioneer on GST paid or incurred incidental to the business of running an auction.

SUMMARY

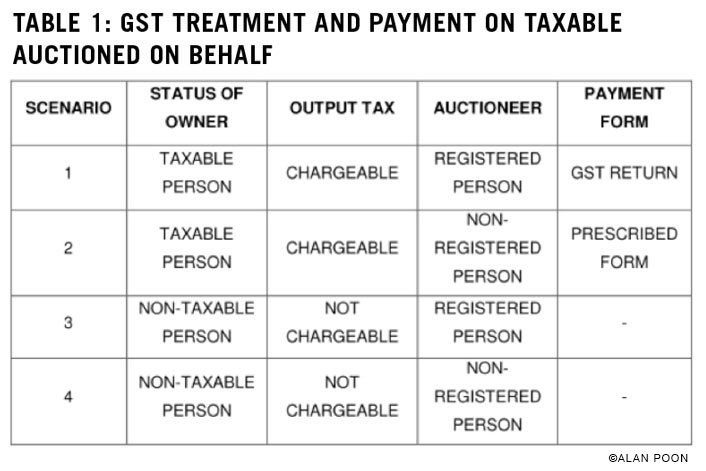

In general, there are four possible outcomes of taxation applicable to auctioned property for budding auction investors and homebuyers to be aware of while hunting for their prized auction units. They are as follows:

-

Owner non-GST registered, residential property

-

Owner GST registered, residential property

-

Owner non-GST registered, commercial & industrial property

-

Owner GST registered, commercial & industrial property

From the above, it is crucial to know that NO GST is required to be imposed on any residential properties that are prescribed as exempt supply goods when such properties are auctioned off, irrespective of whether the owner is GST-registered or not.

While the above may be outlined by the Royal Malaysian Customs, its practical interpretation is subject to the actual presiding factor which is settled on a case-by-case basis so the drastic impact it will have on all stakeholders in the auction property industry has yet to be seen. All in all, one needs not worry if the facts above seem confusing. Auction property investment does present itself as one of the better options to source for below market value properties amidst the GST landscape, while we enjoy and thrive in these challenging times.