The funny thing about bubbles is that sooner or later they burst. After having survived the 1997 crisis as each of us has watched the housing bubble burst in most parts of the country and deflate everywhere else, we are being told that the worst is over. We can come out of hiding and start to resume normal activity.

Hmmmm… I’m not buying it!

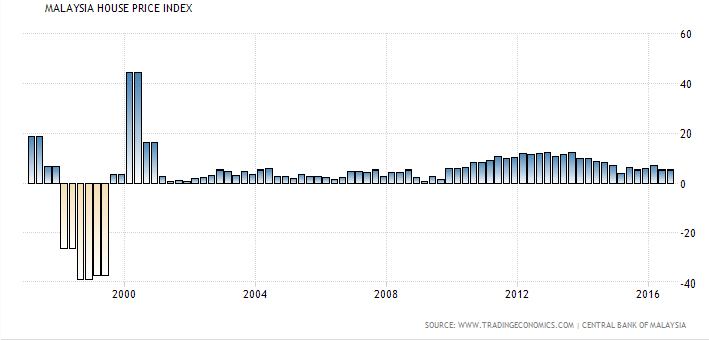

Consider the charts below, that reflects that housing prices in general still have a way to travel, downward

In other words . . . all of the air isn’t out of the bubble!

The Government is continuing to prop up the housing market with things like the Prima housing, etc.

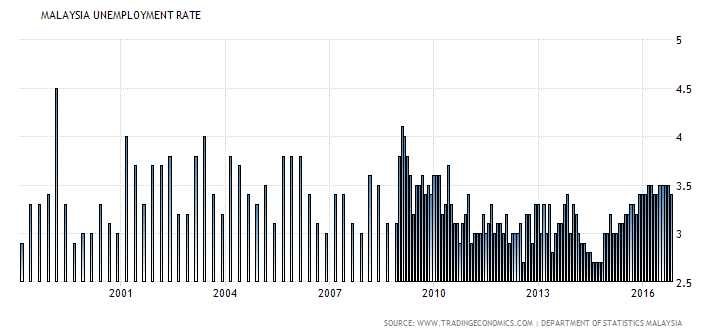

Not forgetting the high unemployment rate, foreclosures rising and rising Government debt – GDP as shown in chart below.

Malaysia’s Unemployment Rate

Malaysia Government Debt to GDP

Impacts of Further Housing Price Declines

-

Instead of inflationary pressures we could be poised to see real deflationary tendencies across the broad spectrum of our economy. Hopefully this will not happen. If you think the billions in dollars of lost wealth were tough… the next round could be even worse.

-

Banks, you may recall, are still holding the majority of their bad/foreclosed loans at their original values and if housing prices continue their decline to parity with affordability, bank balance sheets will be hard pressed to recover if they ever can.

This sounds like dire stuff. And it is!

Surviving as a Real Estate Investor…

The great news is that we provide a product that is one of the basic human needs. Food, clothing, shelter! People will always need a place to live. Good news for us.

The Good News

There is good news in all of this bad news. All of the negative events are creating an abundance of opportunity. Whether you are looking at real estate, the stock market, or some other investment opportunities, there are fantastic deals everywhere. I am reminded of the adage that states: be fearful when people are greedy and greedy when people are fearful. A great number of millionaires were created during the Great Depression, so be bold and seize the opportunity.

Our Challenge…

Our challenge is to not become a part of the unbridled enthusiasm that seems to be sweeping the housing market… again. This means:

- Sticking to the fundamentals.

- Not counting on appreciation to give you your profit. And…

- Not being over confident and ensuring that you buy at prices that won’t leave you exposed to further declines.

As I have heard said… Be Careful Out There!

As always your comments and thoughts are always welcome.