Where are the best property investment locations? If you have enough experience investing in property, you can make money almost anywhere, but there are always places that are better or worse for property investments. For maximum profits, you want places that have a better demand/supply ratio. You can use the points below to identify the locations.

The Demand

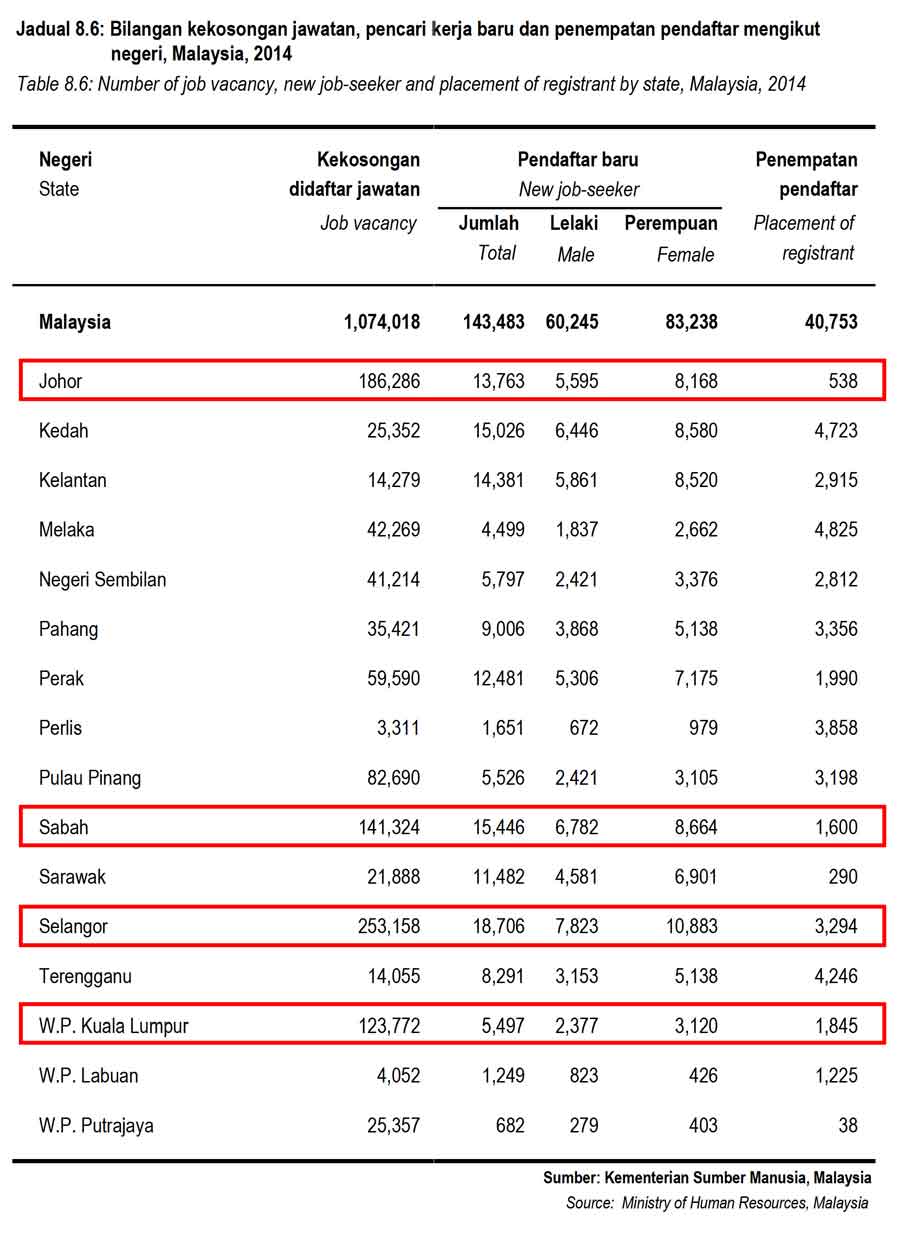

- Does the area have decent job growth? Ideally, you want to see job growth equal to or exceeding population growth. You also want areas with professional jobs moving in. It is estimated that for every professional job created, there are four service jobs created, and all those employees need a place to live. Population tends to move when there jobs available. Do check with Department of Statistics Malaysia for population growth indication. See example below.

-

Is the population growing? Stay away from areas that have little growth. You don’t want to buy a property in an area where people are moving out.

-

Is there a decent quality of life? Some may find it irrelevant, but as an investor, this is important. Are there cinemas, malls and hypermarket? Many areas have at least one hypermarket and nowadays independent coffee shops are booming that drive people into the area. Trendy areas usually have increasing demand for housing. It’s also a good indication of a high quality-of-life if people are willing to take lower-paying jobs just to live there. One quick way to identify population number is to see where the hypermarket is opening and other businesses such as banks etc. These businesses have invested hundred thousands of ringgit if not more in their feasibility study to make sure there are enough population to support the businesses.

Property Supply

-

Number of property for sale? Lower supply of homes for sale means upward pressure on prices. This indirectly drives up rents as well, which makes for better investing.

-

New development? Census figures can tell you what’s happened over the last ten years. Check with National Property Information Centre to see if the the number of housing units they’ve issued permits for is more or less than the expected population growth.

-

Rent and vacancy levels? Rents have to be high enough, and vacancies low enough to justify investing. When we researched for our next potential investment, we looked into a small area in Kepong with rental yield less than 2 per cent per annum. With this rental return makes great place for renters, but not so great for landlords. A quick way to check if the property that you intend to invest has high occupancy is through property listing websites. The fewer the listing available for rent, usually indicates higher occupancy rate. Another way to check for occupancy rate is to physically go to site and see for yourself. And of course, you can always ask the local agents but beware for conflict of interest here.

-

The available land? Of course, less available land is better for future appreciation. When the land runs out, the prices start accelerating upwards.

When you use these questions to compare various locations and cities, you’ll see the differences more clearly. You’ll have an idea about how housing demand compares to supply in each. This will help you pinpoint the best property investment locations.