Is now the right time to buy property?

On Rapid Property Connect FB Page on 16 November there were two articles with differing views on the property outlook for 2018.

It’s always at this time of the year i.e. year end or beginning of next year (2018) that Property Outlook seminars or talks will be held to predict the outlook for 2018. Do you remember the outlook predicted for 2017?

To recap some articles then

I want to get this course off to a strong start, and I can’t think of a stronger way than giving you a superpower: the ability to know what property prices are going to do in the future.

It’s important, because you’ve probably got some nagging doubts about whether now is even a good time to get involved with property. You’ll have read about specific issues facing the market right now, and you’ll have been worried by headlines you’ve seen and friends you’ve spoken to.

This model I’m going to show you will to help you see past all that. By the end of this article I should have convinced you that property is a great investment as long as you do two things: invest intelligently, and avoid buying during one small window of time (and I’ll tell you when that is).

So let’s get to it…

They say you should never talk about sex, politics or religion in polite company. I think there’s a strong argument for adding “property” to that list.

When you’ve spoken to friends or family about property, you’ve probably had some strong reactions – both good and bad. Some people will tell you that property is the only thing to invest in, because “it always goes up”. Others will tell you that housing is far too expensive, and set for a crash.

I suggest ignoring them, because they’re all wrong. (But maybe don’t say that to their face if you want to be invited for dinner again.)

Most people’s opinion is based on emotion, not facts. Someone who scared you out of buying in 2001 because “prices will only fall further” would have talked you out of some incredible years of growth. But at the same time, someone who told you in 1993-1996 that “prices only go up” could have encouraged you to buy at what turned out to be the peak of the market, and suffer massive losses.

The media’s track record isn’t any better. So how do you know whether now is the right time to buy property is?

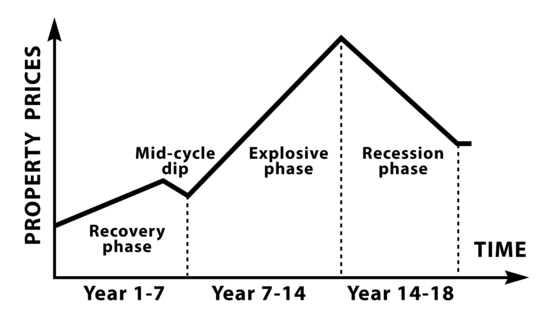

Nobody has perfect vision of the future. But there’s one model that’s been pretty accurate for the last 200+ years or so: the 18 year property cycle. And it looks like this:

The cycle never lasts exactly 18 years: 18 years is the average length of each cycle going back hundreds of years. Usually though, it’s not too far off. Click here for more info on the Malaysia property cycle.

Take recent history as an example. From the financial blow-up in 1997, we had about four years of falling prices – the “recession phase”. Then since 2001, prices have been picking up – gradually in some areas, and rapidly in others.

**So where are we now? **If the cycle is running roughly to time, we’re around the recession phase again i.e. 4-year down cycle which started in end 2016. That means we can expect prices to continue to fall before the Recovery phase.

The cycle gives us a way of answering that very important question: is now a good time to buy property?

The absolute best time to buy property is right at the bottom before the start of the recovery phase but of course, that’s the most difficult thing to do – because you’re scared, and so is everyone else.

In fact, to have a successful long-term investment, all you need to do is avoid buying in the couple of years leading up to the peak of the market. Because each cycle starts at a higher level than the previous one, just avoid those couple of years and over the decades you’ll do OK.

But here’s the funny thing: even though evidence for the cycle goes back hundreds of years in countries like US, UK, Netherlands, Australia etc– and think about how much has changed in the last 18 years, let alone the last 200 or 400 years in developed countries above– it’s always tempting to think that things are different this time.

Prices in parts of the country are already falling. The developers have been changing their plans to sell more affordable homes with smaller size and fewer frills for 2017.The high retrenchment rate, the more stringent lending policies in most segment of the industry except the affordable category wherein the government seems to be taking great effort to assist. The economy seems weak, and there’s the high household debt at about 83% to deal with.

These are some of the very real challenges, which you need to be aware off. But that doesn’t mean that “things are different” and the cycle won’t apply. The cycle has held true through periods of massive technological and social change everything except world wars, in fact. Is our current situation more unusual than anything that’s happened since 1800? It seems unlikely to me.

This has been long, so I’ll let you go in a minute. But let me leave you with this

Maybe you don’t believe in the property cycle at all. Maybe, for one reason or other, you don’t think prices are going to fall from their current level.

And that’s the beauty of property: all you need to do is avoid buying at the absolute worst time, and you should find it grows over the long-term and pays you every month in the meantime.

That’s quite enough for this article – I hope I’ve not scared you off already!

If you’d like to learn more about the property cycle, click here to find out more on the book I have written on the Malaysia 18-year property cycle. For the unprepared, these challenges are huge. But the book can show you how you can use them as a big opportunity.