TL;DR

-

Majority Cambodians are earning $1,000 per month;

-

Rental in Phnom Penh is higher than average salary earner;

-

Condo might not work in Cambodia because locals are favouring shophouses or landed houses;

-

For foreign investors, try to invest in properties that have the most local base.

Cities all around the world play important role in stimulating the economy in a country. According to Oxford Economics, in 2023, the 1,000 largest cities in the world accounted for 60% of global GDP. In recent Oxford Economics Global Cities Index 2024, which developed by Oxford Economics to provide a holistic assessment of the 1,000 largest cities in the world leveraging on economic data, and supplemented by other publicly available datasets to allows the consultancy firm to directly compare cities around the world on a range of metrics.

The index contains five categories which are aggregated to create a overall score for each city.

- Economics,

- Human Capital,

- Quality of Life,

- Environment,

- Governance

Each category is comprised of multiple indicators (four to six, depending on the category), which aim to address some of the most important considerations within their respective categories. As a result, the Global Cities Index provides a more complete comparison of cities, by ranking them not just on their economic performance, but considering other important factors that influence their relative strengths. With a total of 1,000 cities and 27 indicators included, our truly global and multidimensional coverage allows us to provide a remarkable breadth and depth to the Global Cities Index. Definition from Economics Global Cities Index 2024 report.

How Southeast Asia Countries Performing?

It is always interesting to see how ASEAN countries are performing in global ranking.

Global City index 2024 for SEA countries

- Singapore, Singapore - 42

- Kuala Lumpur, Malaysia - 135

- Bangkok, Thailand - 192

- Manila, Philippines - 256

- Jakarta, Indonesia - 284

- Hanoi, Vietnam - 304

- Yangon, Myanmar - 680

- Phnom Penh, Cambodia - 687

Not bad for Malaysia ranked at 135. To know more how each countries are being evaluated, check out the Economics Global Cities Index 2024.

Cambodia Economic Overview

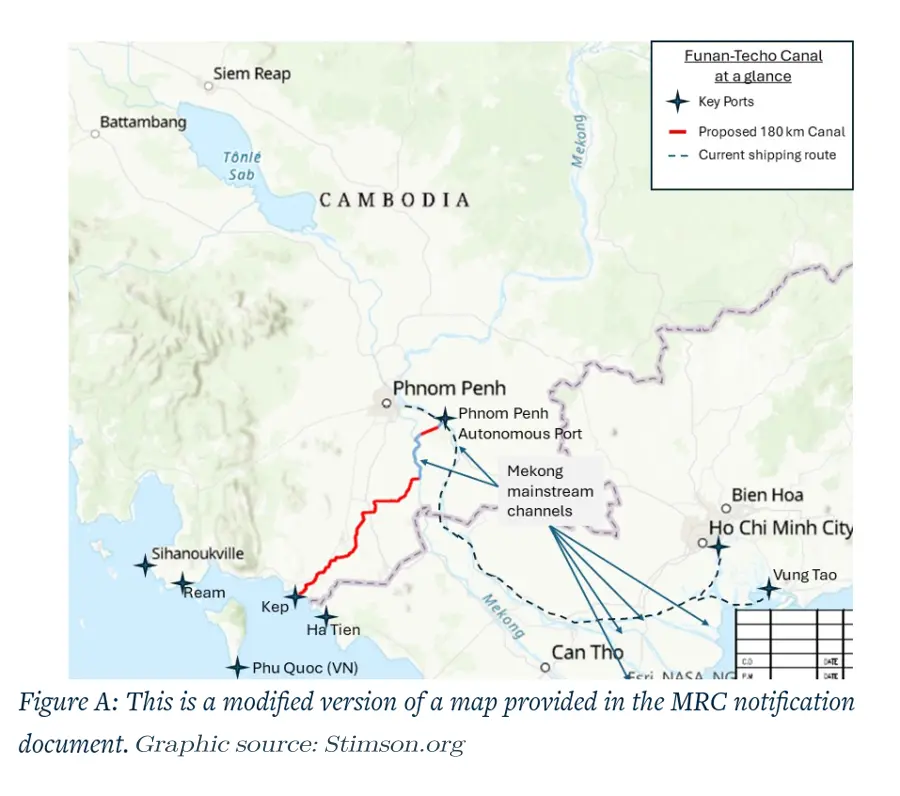

The Funan Techo Canal, Phnom Penh, Cambodia

It is always interesting to see how Cambodia is developing. For some reasons, the country seems to skipped an era and propel to the future. More on this later in the post.

The economic benefits of the Funan Techo Canal are manifold. Spanning 180 kilometres, the canal will link Cambodia’s capital, Phnom Penh, to the Gulf of Thailand, significantly impacting the nation’s economic landscape. The $1.7 billion project, with 51% of its cost funded by Cambodian companies, is expected to transform Cambodia into a major logistics and economic hub within the Mekong sub-region.

One of the primary advantages of the canal is its potential to enhance trade and regional connectivity. By providing a reliable and efficient transportation route, the canal will facilitate the movement of goods, reducing Cambodia’s dependence on neighbouring Vietnam’s ports by up to 70% for international shipping. This strategic advantage allows Cambodia to assert its economic sovereignty and reduce reliance on external trade routes. - TheBetterCambodia.com

Cambodia Funan Techo Canal Route

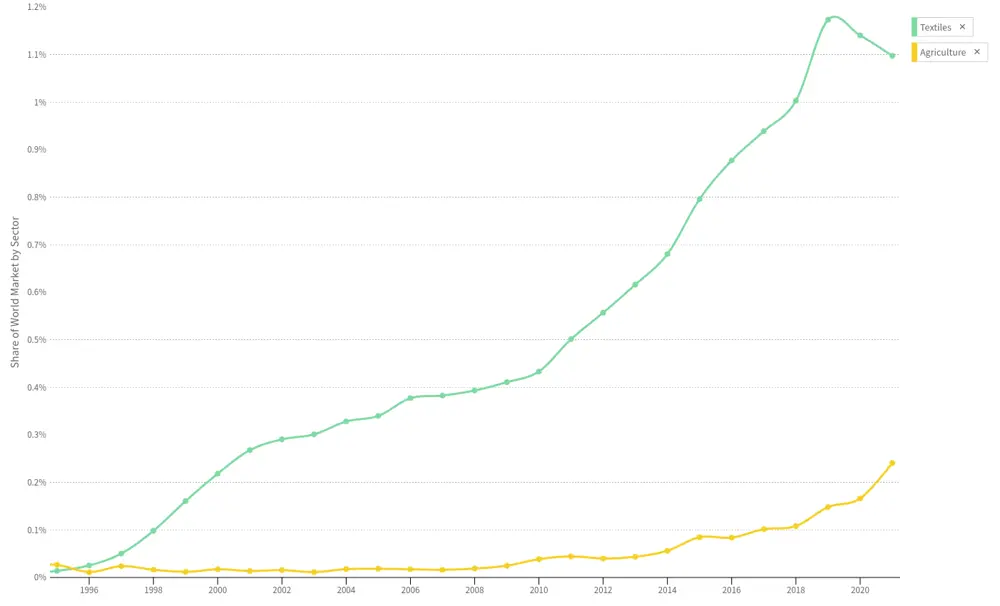

Cambodia’s Global Export

The main produce for Cambodia is primarily in manufacturing and agriculture. In which, manufacturing accounted for 56.82% and agriculture 22.58%. Top three manufacturing are Sweaters, Pullovers, Sweatshirts (13.84%), Women’s suits, knit (10.74%) and Women’s Suits and Pants (8.66%). While agriculture producing related produce Trunk & Cases (31.87%), Cashew Nuts & Coconuts (16.53%) and Rice (13.35%).

The major export for Cambodia is the United States (34.82%) followed by Vietnam (11.79%) and China (7.51%).

Property & Population in Phnom Penh

The Average Income in Phnom Penh

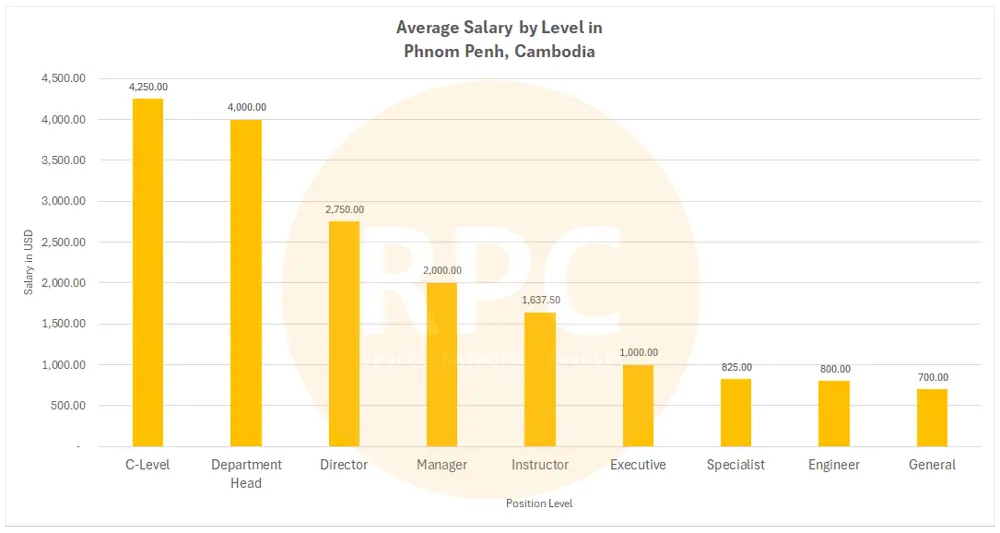

Getting the information for salary in respective of industry is not an easy task. This is not due to lack absence of data but rather expected salaries were not disclosed or simply “negotiable” is mentioned. In my case, I do not need the exact salary for specific position but rather a range will suffice. The other challenges is many positions were posted by recruiting agencies rather than the actual employing company. Almost half, 49.7% to be precise job posted were from recruitment agencies.

Interestingly, the four positions namely Executive, Specialist, Engineer and General pay range are not far apart. Even more interesting is the engineering jobs are being paid only slightly higher than general jobs.

These metrics are very important to gauge the spending power of the local population. And of course, this is not an in depth research into the topic but rather a quick glimpse into the affordability in the city of Phnom Penh.

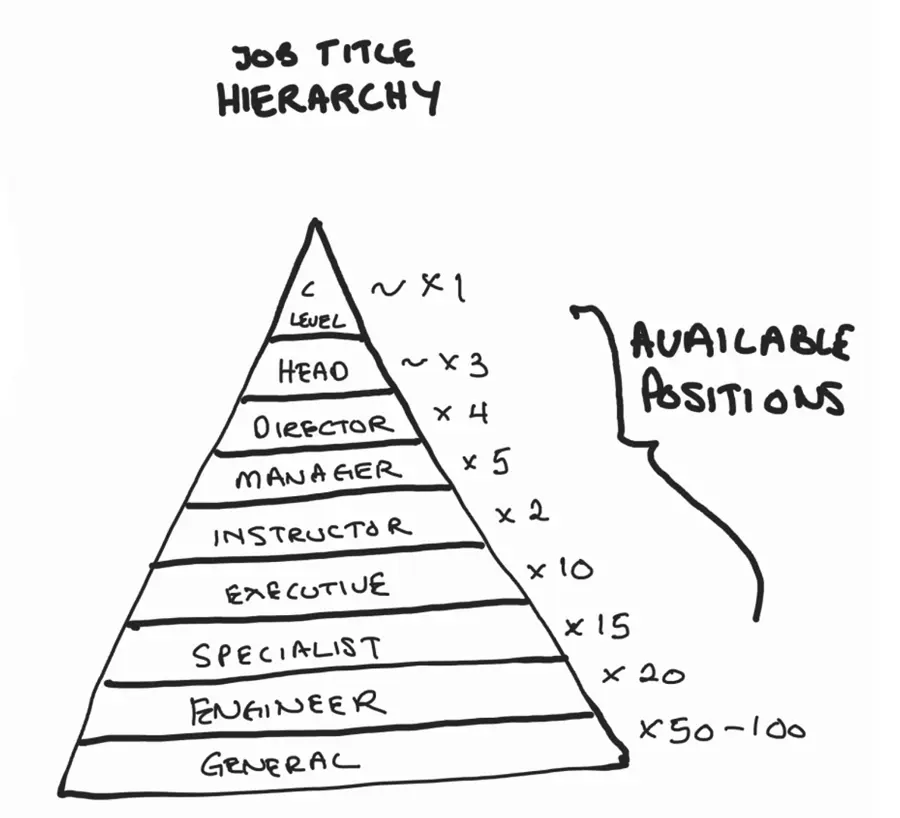

Let’s ponder with a simple logic below;

The majority of positions is on the lower part of the pyramid. Translate the same to the Average Salary chart above, the majority of the people are actually earning $700 - $1,000 per month.

And you will ask, how is this relevant?

Now, let’s move on to the next analysis.

The Average Rental in Phnom Penh

In my book Best Time to Invest in Property - Yesterday, I did mention that some of the properties are not suitable for local Cambodian. This is mainly due to affordability issue. And this post confirmed just that.

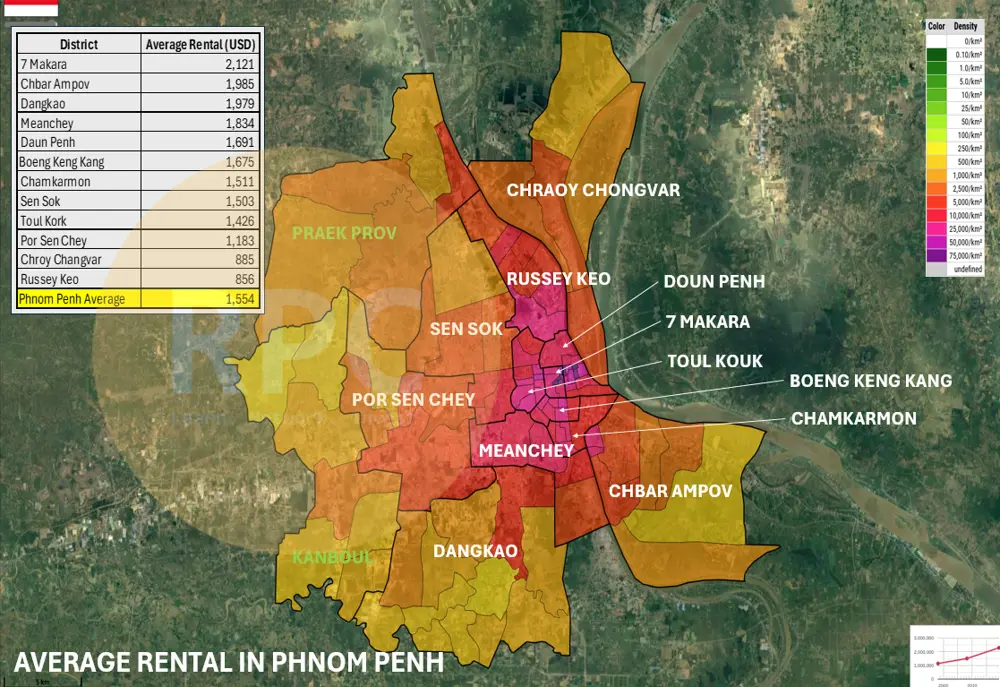

Below is the Average Rental in Phnom Penh that I plotted in the map for easy reference.

The highlighted area is Phnom Penh with its districts. The most expensive and densely populated area is 7 Makara, Doun Penh, Boeng Keng Kang and Toul Kouk.

With the map above, we can easily see that those below managerial level salary earners would be a little difficult to rent property in the city. See example below.

| DESCRIPTION | USD |

|---|---|

| Position | Executive |

| Monthly Income | 1,000.00 |

| Monthly Rental in Russey Keo | 500.00 |

| Monthly Expenses (30%) | 300.00 |

| Savings | 100.00 |

| Disposable Income | 100.00 |

The above is just an illustration of typical salary for an executive renting an apartment in Russey Keo which is also below average rental in the area. The rental itself already accounted for 50% of the income.

Since, almost 79.4% are in manufacturing and agriculture, unless those factories and plantations are situated in Phnom Penh, otherwise who is going to stay in the city? The answer to this question will be in later part - investment perspective.

Of course, this is what we see from big picture. Many Cambodians can easily navigate their way from ‘financial trap’ which is to avoid certain types of property.

The Evolution of Property and Trend

For this to make sense, I have to guide you to see how Malaysia’s property evolved over the years. The reason why I picked Malaysia is for one obvious reason - I stay and live in Malaysia and I see how the properties changed over the years. Second, Malaysia is a Southeast Asian country and we shared some similarities in terms of architecture, building material used, etc.

Back in the 80’s, landed properties e.g. terrace houses is the main choice. In fact, landed property is the only choice available at the time. Going into 90’s, slowly we could see many high rise building being built. At first, shop apartment of two floors then four floors. Soon after, 16 to 18 floors of shop apartment were built. Townhouse is another category of its own. Reasonable space and price. Feels like living in a landed property but its not. It is actually few owners shared the same plot of land. Townhouse was quite popular around 2005 - 2009. Though most of this type of property sold out but it is not a kind of popular type of property that people will keep on buying.

Let me know in the comment below if you want me to explore on Townhouse in my next post.

Starting year 2010 - 2013 is where most condos being introduced. Malaysia’s property market boom was in 2013. You can learn more about 18 Year Property Cycle in Malaysia here

I don’t have the exact timing for residential property in Phnom Penh. However, by the design, the buildings should be as below;

Shophouse is very popular in Cambodia.The demand is high. Typical shophouses have many rooms. Some go upto 24 rooms. Each rooms are ensuite that comes with private toilets.

In Malaysia, we have similar shophouse like this too (see photos below). Multiple stories and many rooms. Many families usually living within the same building. Those were the old practise. Land is scarce and this type of property become less favourable due to cost. Other reasons we don’t see much this kind of building is because the behaviour of consumer had changed. Family moved out and staying in their own property. From 80’s, Malaysia’s economy boom along with the nations income. Many Malaysian could afford to buy their own property. It was affordable at the time. These days, it is no longer affordable due to land scarcity that pushes the land price up. Malaysia housing is then made affordable via government initiative such as PR1MA, RUMAHWIP and Rumah SelangorKu.

Even with affordable homes, some projects still unsold. This is mainly due to the younger generation - GEN Z to be precise that they do not prefer to have long term commitment that ties them financially. This is another topic all together. If you like me to explore on this, let me know.

Condo Might Not Work in Cambodia, Here’s Why.

Single Market Focus Risk

One key risk for Cambodia’s condo market is the overreliance on foreign buyers. The majority of condos seem to be targeted at expatriates and investors from abroad. While this might appear lucrative initially, the concern is when we examine the proportion of foreigners in the country. The percentage of expatriates or foreign investors in Cambodia is relatively low, and this causes issues for resell.

For any property market to remain sustainable, there must be a strong domestic buyer base. In Cambodia’s case, the average local resident cannot afford these high-end condos, as previously discussed with the income and rental comparisons. This creates a potential long-term risk for developers and investors.

It is clear to me that the developers are not targeting the condo for the local Cambodian. And we can see from these sample ads.

Affordability Gap for Locals

The affordability issue for local Cambodians is clear. While the monthly income for a significant portion of the population is around $1,000, the cost of owning or renting a condo in Phnom Penh is much higher. After considering living expenses, the disposable income left is insufficient to meet condo prices or even rent in most cases. This explains why many Cambodians opt for more practical housing solutions like shophouses or landed homes, which offer more space and value for their money.

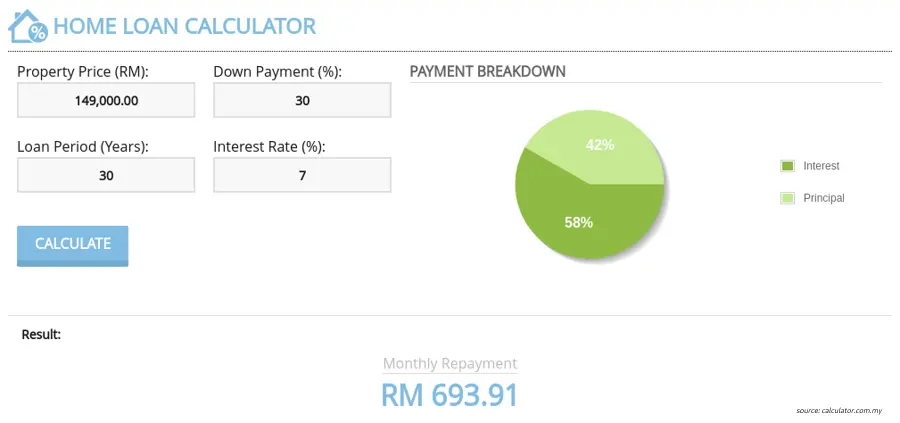

Referring to the Average Salary chart, the majority of the population is earning about $1,000 per month. After deducting living expenses of 30%, one has a balance of $700 disposable income. That is assuming no other expenditure. For a condo that cost $149,000, the instalment per month is $693.91. This example is not even in the best location and cheapest. If we are going to look from an investment perspective, the property is giving 6.89% rental yield (based on selling price of $149,000 and $856 monthly rent) - Click here To know more how to calculate rental yield and ROI

Sudden Shift in Property Types

Another factor to consider is the rapid shift in property development. In many other countries, there has been a gradual transition from landed properties to high-rise living over decades. This slow change allows consumers to adapt their expectations and preferences. In Cambodia, however, the jump from shophouses to condos has been abrupt, and the local market may not be fully prepared for this change.

The consumer behaviour in Cambodia still leans towards traditional property types like shophouses. Even though high-rise buildings are becoming more prevalent, many buyers still see more value in shophouses, where they can live and possibly operate a business under the same roof.

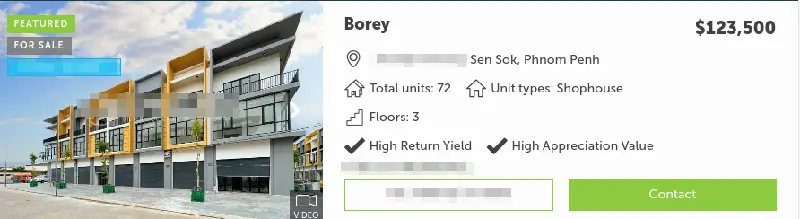

Local Cambodians prefers both shop apartment or landed houses. They are more practical and value for money. Below is an example of a property price almost the same as codno but has much bigger built up. Furthermore, the property is a shophouse which is more practical to stay.

Investment Outlook

For foreign investors considering condos in Phnom Penh, it’s essential to understand the risks. While rental returns may look attractive, the potential for an exit strategy remains a concern. Given the current local demand and income levels, the ability to sell these properties later may be limited. If the market relies too heavily on foreign buyers, the resale options might shrink if investor interest declines.

For those looking to invest in property with long-term potential, it’s crucial to evaluate both rental income and exit possibilities. My book, Best Time to Invest in Property, explores how to assess these risks and provides strategies to find properties with sustainable rental yields.

Feel free to leave your thoughts in the comment section below. What you think on the topic I’ve just shared.

Until next time. Cheers.

Danny