Inflation is defined as a sustained increase in the price of goods and services seems to be inevitable. Generally rising prices are bad news for consumers, as it takes an ever-increasing amount of money to purchase the same basket of goods and services year after year, inflation can be quite profitable for investors

Inflation erodes the value of a nation’s currency. In an inflationary environment, a loaf of bread that one cost RM1.20 may now cost RM2.80. There are a variety of factors that causes and influence inflation, but for consumers and investors, the end result is the same. Prices rise.

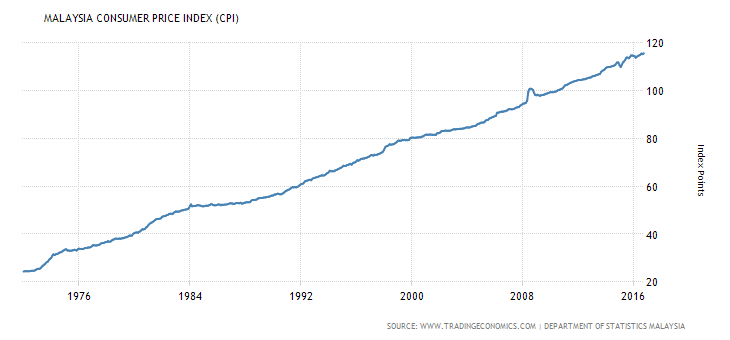

Now you may be concerned about whether you are actually losing money on your savings. So how do you measure the effect of inflation? There are certain indices that the government puts together to measure the effect of rising prices. The Consumer Price Index includes the prices of a variety of goods and services that consumers buy. This includes the prices of transportation, medical care and housing, among others. A rising CPI indicates that the costs of such consumer items are increasing.

For investors, the key to making money in an inflationary environment is to hold investments that increase in value at a rate in excess of the rate of inflation. A number of investments are historically viewed as hedges against inflation. These include real estate, gold, oil, stocks and inflation-indexed bonds.

- Real estate is a popular choice not only because rising prices increase the resale value of the property over time, but because real estate can also be used to generate rental income. Just as the value of the property rises with inflation, the amount tenants pay in rent can be increased over time, enabling the income generated by an investment property to keep pace with the general rise in prices across the economy. Real estate can be purchased directly by buying a building or accessed indirectly through investment in a real estate investment trust.

-

Gold is also a popular hedge against inflation. Investors tend to turn to this precious metal during inflationary times, causing its price to rise. While silver and other metals also tend to gain value during inflationary times, gold is generally the headline-grabbing investment, with the price of gold rising when inflation is notably present. Gold can also be purchased directly or indirectly. You can put a box of the metal under your bed if a direct purchase suits your fancy. Or you can invest in the stock of a company involved in the gold mining business. You can opt to invest in a mutual fund or exchanged traded fund that specializes in gold.

-

Like real estate and gold, the price of oil, moves with inflation. This cost increase flows through to the price of petrol and then to the price of every consumer good transported by truck or produced by a machine that is powered by gas. Since modern society cannot function without fuel to move vehicles filled with consumers and consumer goods, oil has a strong appeal to investors when inflation is rising. Other commodities such as cotton, orange juice and soybeans also tend to gain in price when inflation rises.

Oil and other commodities are significantly more difficult to purchase directly and store than gold. It is far more convenient to invest in an exchanged-traded fund that specializes in agricultural commodities or businesses or an exchange-traded partnership that gains exposure to commodities through the use of futures contracts and swaps.

- The same logic applies to stocks. Companies can generally pass rising costs on to consumers. Based on this, stocks have a reasonable chance of keeping pace with rising inflation. Some companies have a better opportunity to pass on rising costs than others. Toothpaste and toilet paper, for example, are two items that most people will continue to purchase even when these items cost more at the grocery store

There are pros and cons to every type of investment hedge, just as there are pros and cons with just about every other type of investment. Similarly, there are no guarantees. Whatever course of action you choose, you are taking a chance. Sometimes that chance will pay off, and other times it won’t. In any event, time often heals all wounds. If you can’t afford to be wounded or don’t have the time to wait for recovery, position your portfolio accordingly to minimize your worries.