In Malaysia it is common to buy “Off The Plan/Shelf” from developers when project has yet to start or is under construction. This is because in Malaysia private developers take the lead to ensure the housing starts of the nation are achieved.

Buying a property “Off The Plan/Shelf” means buying a new property before the project is completed.

It is common to buy off the plan/shelf from developers in Malaysia

Buying a property off the plan/shelf has both its disadvantages and advantages.

The advantages of buying a property off the plan are that you can lock in a favourable price at current market value and upon completion reap the benefits of capital appreciation from the said property.

Secondly it has always been shown that property prices appreciate once it is completed a few years down the line. Hence if the entry price is low the upside will be good when it is completed assuming factors like location, type of property and other factors of the property are right. Risk of investing will then be minimized.

Thirdly, as a buyer you will have an advantage of not having to come up with huge upfront payments immediately as payments can be paid progressively as construction proceeded. You also need not have to pay the stamp duty on Transfer upfront until a much later stage.

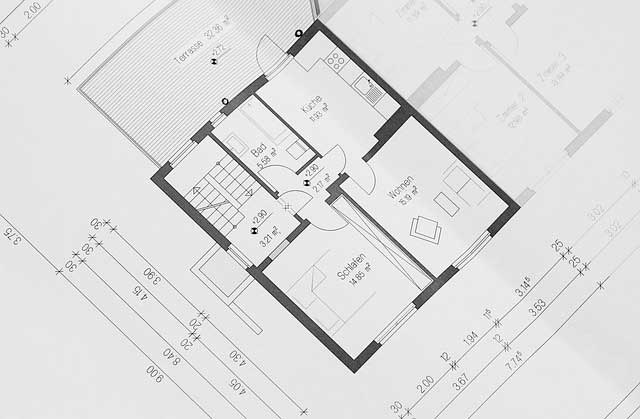

Fourthly, you have the choice to buy the design or layout of the house that meets your needs, in the location you wanted and at a price affordable to you without having to do major renovation to the house.

Last but not least, as the house is new, you will reap the benefits of low maintenance costs during the initial years of moving in.

Buying a new house will reduce maintenance costs in initial years

Despite the potential benefits, buying property off the plan can also be risky. If you are in the market for property off the plan, here are 12 tips to protect your investment.

Research the developer’s reputation and background. The less than scrupulous developers will generally left a trail behind. You would have heard about their projects being delayed, abandoned or noted for poor quality. A good source is to check it out through the Ministry of Urban Wellbeing, Housing and Local Government website that updates the list of projects blacklisted or developers blacklisted.

Conduct market research on resale values, rental value, supply in the area and visit the site during various time of the day. Then do an analysis based on the comparable prices in the area and then evaluate developer’s offer price without taking into considerations the incentives the developers may offer.

To get the greatest return,always buy early in the process or best before it is pre-launch. Most developers generally will increase their selling prices as sales increase or when project is nearing completion.

Don’t be dazzled by the “flash/hypes”. Check basic details such as building specifications and finishes, size of elevators, balconies, parking bays, communal space, maintenance costs, list of facilities, guardhouse etc. It would be wise to keep all marketing materials.

Seek independent legal advice. Do not rely on the solicitors appointed by the developer especially for commercial properties whereby the Sales & Purchase Agreements are not governed by the Ministry of Urban Wellbeing, Housing and Local Government. This is because the terms in these Agreements are generally more favourable the developers. Thus you need to be aware of the terms before you buy else you may regret later.

Check the mundane details, including utility charges – commercial or residential rate, broadband availability and fire safety.

Ensure you understand what the developer may modify, and negotiate to preserve your right to cancel the contract if there are significant changes including adding levels thereby increasing the units or floor area, reducing open space or additional block that was not make known before purchase, land is further charged without prior notification and entails higher redemption sum from the original specified.

When is the deadline for completion, otherwise known as the Vacant possession date. What are the financial consequences if the project is not completed on time? Will you have the right to cancel, at what point and with what financial ramifications? Generally in Malaysia once the loan sum has been disbursed it is very difficult to cancel the purchase unless one is willing to repay the loan sum released to the developer by the bank.

Monitor the progress of work to ensure work is on schedule. You may also check the work progress status through the Ministry’s website and to sound the alarm to the Ministry when things are not right. By so doing the Ministry will then step in to conduct inquiry and will also monitor the payments in the developer’s account. Ministry can stop all payments if the developer abandons the project.

Make sure that the plan has Local Council approval and also a valid Developers’ License and Sale & Advertising Permit for non commercial properties before buying.

Study the project in totality. Don’t just buy a property based on what the agents recommended or crowd effect. Generally agents will always tell you to buy now before the price increase in the next phase and price of next phase will increase by X%. There is no guarantee that it will. Also take note of the density of the whole development. A project with very high density generally does not have a high resale value or capital appreciation due to stiff competition.

If you are buying the property to flip, you need to check out the charges to be imposed by the developer, interest costs, legal cost, RPGT and other costs before you buy to evaluate whether it will be profitable to flip. Of utmost importance is the timing of purchase.

Buying a property “off the plan” may be a smart move, but buyers should protect themselves with due diligence and thorough understanding of the contracts or terms, costs and others to ensure your investment will be profitable.