If you are still wondering whether you should start investing property in 2020 , I strongly suggest you don’t thinking anymore and start taking the action to invest now. There could be never better time to invest. Just like stock market, there are many indicators which tell us that it is the right time to invest. For now we are not going to cover how to look for properties to invest. If you want to know the basics, I strongly suggest you to download two of our eBooks - Property Investment 101 and 9 Useful Guides in Property Investment. You can find the eBooks here.

Back to the market indicators, why I urge you guys to invest in property now. Literally NOW!

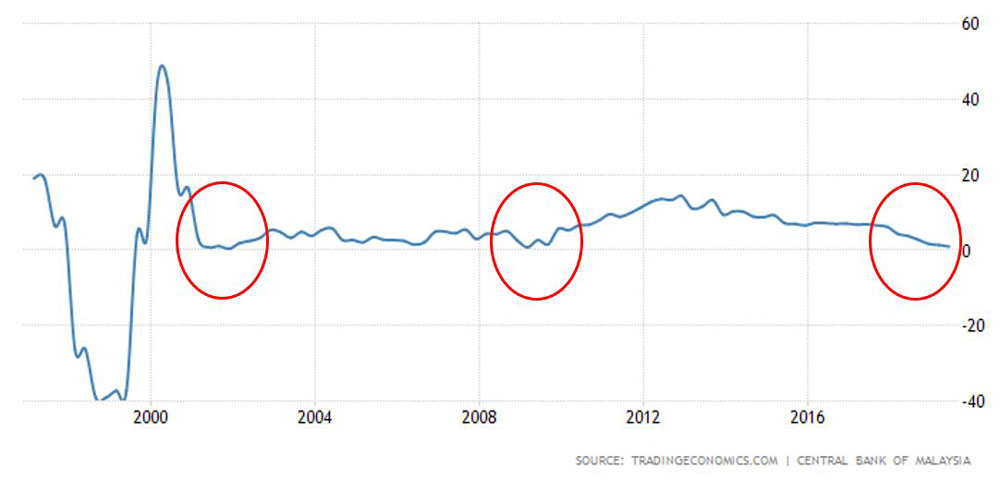

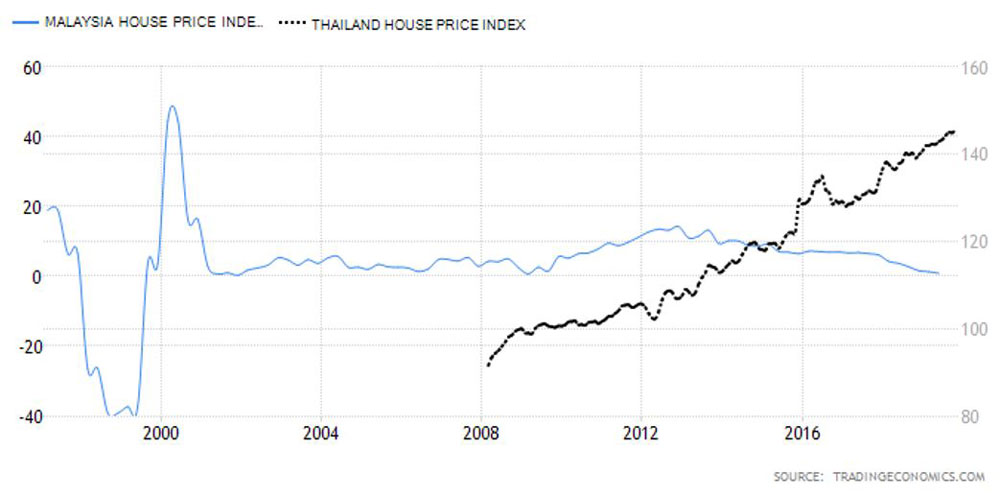

Housing Price Index is all time low

This has been preached since forever where investors are told that BUY LOW, SELL HIGH. A lot of people understood this concept but how many of them actually took action and go for it? I’m not just referring to property investors, but to stock investors as well. I have peers that knew the price is at all time low with good fundamentals, yet they never took the action to invest. No matter if you are value investors or property investors, if you going for keep strategy (keeping for 5 to 10 years or more), you will win eventually as property prices tend to increase overtime due to scarcity of land and stock prices increase because of inflation (provided that the company’s fundamentals is right).

If you are international property investors, then you should know that clearly it is the time to invest in Malaysia. Taking Thailand for example, though the absolute price is affordable to Malaysian, but the price-per-square-feet is much higher. Not to mention that if you are buying today, you are literally buying at the peak. This is against the fundamental of investing to always buy low and sell high. What goes up will come down and same goes to Thailand. It is a matter of time before the market will correct itself and you will see prices start dropping. Phnom Penh is an example where I don’t believe in their fundamentals particularly on new development on condominiums.

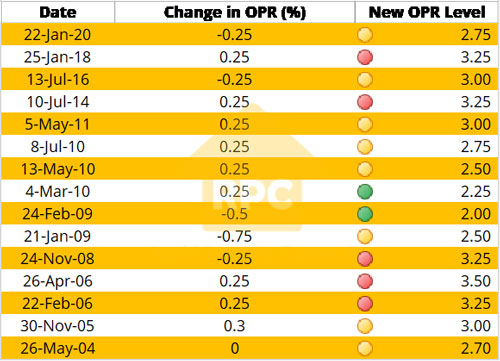

Bank Negara OPR reduced by 25bp

I’m sure that you read or at least heard about the reduction of OPR by Bank Negara recently. This is another indication where it tells us to start investing in 2020 particularly in property. Please be aware that although Bank Negara reduced the OPR by 25bp doesn’t mean the banks will follow to reduce their mortgage interest rate! Do check with your bankers prior to obtain your loan.

Source: Bank Negara Malaysia

Source: Bank Negara Malaysia

Now assuming the banks will follow to reduce the interest rate, it means that your instalment would be lower. Thus, it would be much easier to be eligible to get the loan. However, the caveat is that the bank might imposed a strict screening process in order to approve the loans.

Looking at the history, the OPR would not stay for long. It usually last for few months only. So, if you are planning to invest in property, do it sooner – provided that you have done all your homework to determine what property to invest.

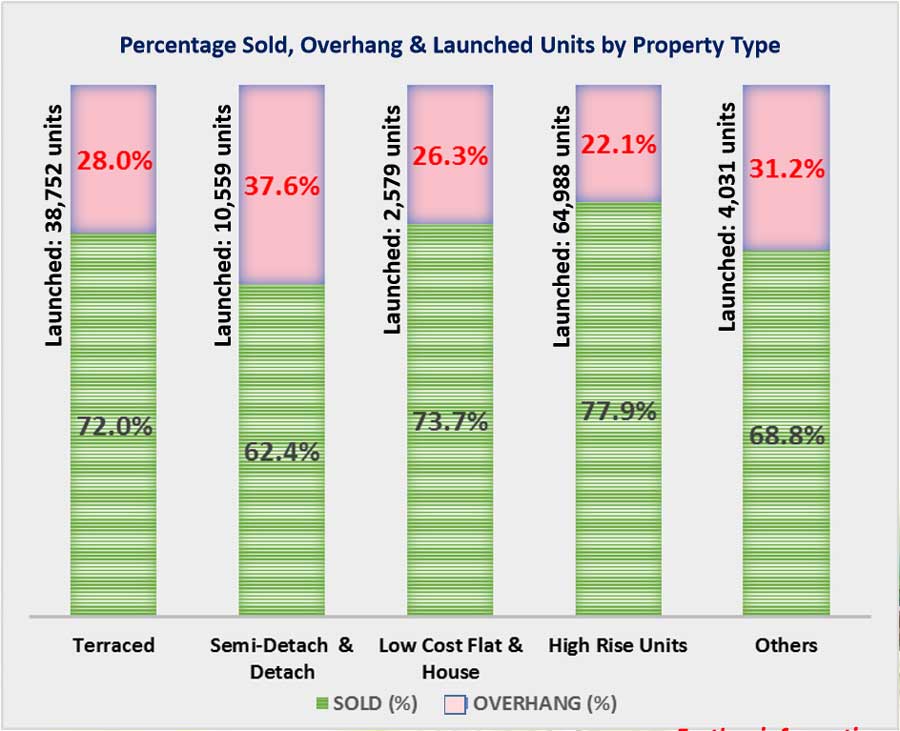

Prices at all time low

Here is one of the best parts. This is where you will get good deals from developers. Many developers are launching new projects if not multiple projects running concurrently. The developers’ inventory need to be cleared to allow more funds to come in. Across Malaysia, especially the west peninsula we could see many great deals offered by the developers. You need to know if the price offered by the developers are the best in the market. Some agents will be able to negotiate on your behalf and there are some investors clubs out there that they negotiated the deals for you with great bargain. Word of caution though, not many investors club out there are giving the best deal to you. So my word of advice, do look around and talk to as many property investors as you can come across before you commit to invest in any of these deals as sometimes it looks good at the frontend but backend numbers are way off fundamentally. Do not follow the crowd when it comes to property investment!

Affordable Property

When I first entered the property market, there was no such thing as affordable housing projects. Everything was at the market rate. Please take note that affordable housing is not a low cost housing. Some people misunderstood this thinking affordable projects are meant for low income earner. Well, if you see the average price of affordable property is about RM300k. The minimum income required is RM3,500 per month. The truth is that the majority of the people are earning less than RM3,000 per month. This excludes the down payment of 10% which the main problem why people unable to buy their first home. So yeah, affordable housing is not cheap and low cost as you might think.

These days, you don’t need to go for normal developers’ project at market rate as you have the choice to buy affordable housing. The downside to this is that most affordable housing tends to be higher density, hence it takes longer to sell the property and to fetch higher rental due to stiff competition.

The best time for Subsale!

The previous few points I just mentioned about primary market. The real gem is subsale. Only those seasoned investors will usually appreciate to invest in subsale property. If you are financially able, do consider to invest in secondary market property as it is much safer for the reason that you could check for physical unit, verify the numbers and know the target market. Buying from secondary market is not always easy as you need to look for your own lawyers and there are many costs involved. So, I would say that subsale is certainly not easy, but the return is certainly worth it. At this point of time, you could easily negotiate for 20% – 30% from the market value. This is a solid discount unlike developers’ projects which the prices are mostly artificially inflated. This is the reason why when a developer’s project completed, the price would drop due to banks deemed it as subsale.

Conclusion

To tell you the truth, there is not many time that you can see such ‘combo’ happen at the same time. We have property prices at all time low, OPR reduced, overhang property in the market, etc. What is your excuse not to invest? Remember what Warren Buffet once said -

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.

Well, this is indeed true. If you don’t invest now, then you might really missing the boat and wait for the next cycle. This could be 18 years later. So you know what to do now - which is start investing property in 2020! By the way, if you are interested to know more how property market works, check out this book by clicking here.