For years it is interesting to note that property cycle comes and go and no one ever question it. It is so predictable and will happen automatically as in the pattern of day follows the night.

Wikipedia described it as “A property cycle can be seen as a logical sequence of recurrent events reflected in demographic, economic and emotional factors that affect supply and demand for property subsequently influencing the property market.

The first recorded pioneer of studying property cycles was Homer Hoyt (1895–1984) in 100 Years of Real Estate Values in Chicago”

The property cycle will moves from Boom – Slump – Recovery, a continuous recurring and predictable cycle.

In current Malaysia context, are we still in the boom cycle where prices are still rising despite the drop in number of transactions?

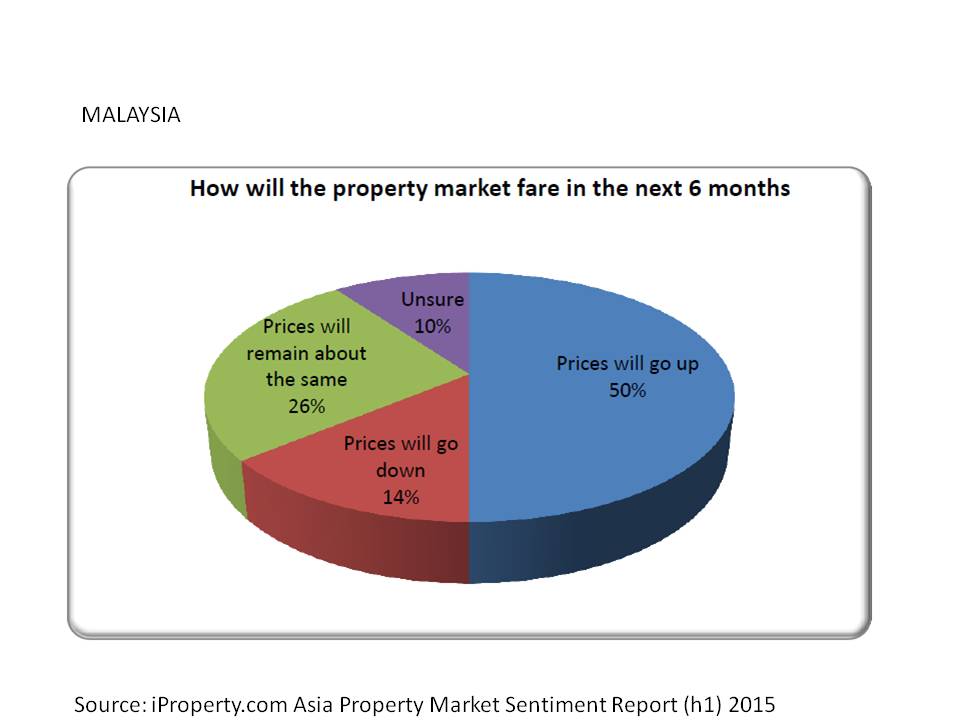

In the latest sentiments survey by iProperty.com is shown in the charts below on the market sentiments on the property prices for the next 6 months’

From chart above, 50% of Malaysians thinks that prices will continue to rise in the next 6 months.

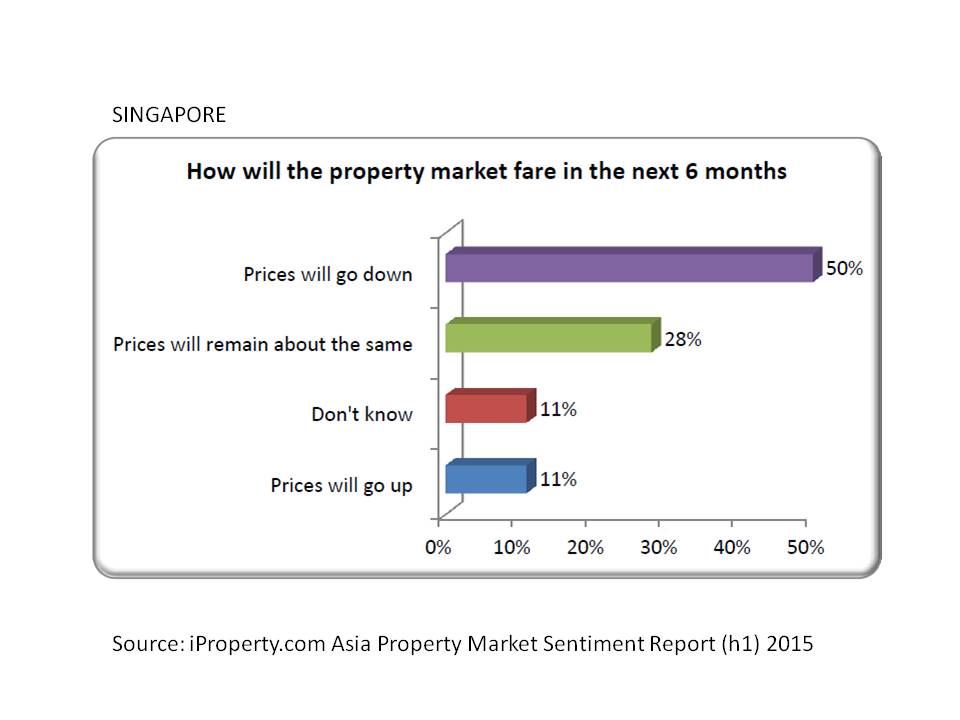

Whereas, on the other hand, our counterpart Singaporeans’ sentiments was a direct contract to that of Malaysian, as shown in chart below. They -50% of the respondents perceived that the market prices will continue to fall in the next 6 months.

Can this drastic contrast between Malaysia and Singapore be due to the GST factor?

Is this truly a case of rising prices due to the impending implementation of GST on April 1,2015 that reflects the sentiments of Malaysian or it is just based on their guts feel of the market based on the news that Malaysian read or hear from various sources in the market?

Or could it be a case, whereby Malaysia is lacking in current data that are not available to the public compared to Singapore where data can be easily available and are timely, that leads Malaysian to think that prices will continue to rise?

I personally find this intriguing for generally Malaysian and Singapore property cycles have over the past years been quite consistent i.e. we being in the same region experienced the same property cycle.

When we look at a basic property cycle of Boom, Bust and Recovery, with Malaysia sentiments of rising prices connotes that we are still in the boom stage whilst Singapore is going into a slump stage with falling prices.

What is your view on these contracting views? Is Malaysia in the boom or slump stage?