Exactly two days ago, The Star released a news article on Malaysia property market 2021 is set for year end bounce, which I personally think that it is a little bit optimistic.

I’ve been talking about this for the longest time that property is the biggest ticket item to purchase in their lives in majority of people. Thus, financing is inevitable. And in fact, it is a norm to get financing from the banks. In other word, we leverage on the banks to make the purchase.

Now, let’s look into the article:

HOUSING demand has remained steady amid the Covid-19 pandemic, as mortgage approval trends continue to rise and developers get creative at driving sales during unprecedented, tough times. - The Star

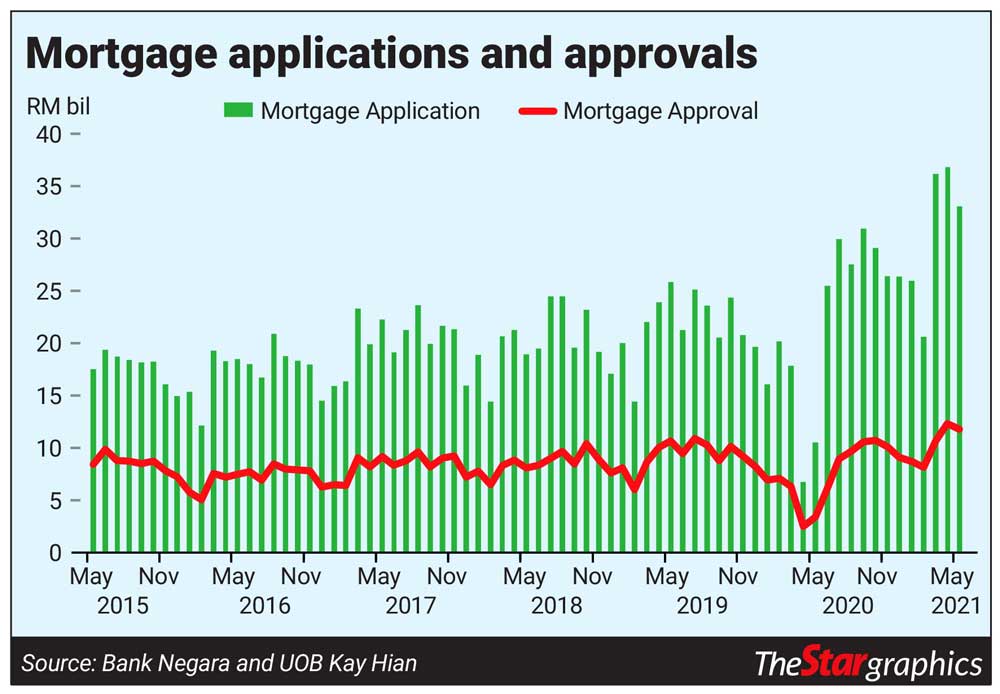

No matter how I see it, the mortgage approval trend doesn’t seem to rise. In fact it should be the opposite.

If we look at the graph from the Star, straight away we could see that the value for mortgage application is certainly more than mortgage approval. I certainly do not agree with the statement that the mortgage approval is rising based on recent data from January 2021 - May 2021. It would be correct to say that the number of approval increased from May last year.

Instead of looking at the six months period for increase ‘value’ of mortgage approval, we should be looking at the typical approval rate.

See also: How Covid-19 Pandemic Impact on Property Market in Malaysia 2021 – 2023

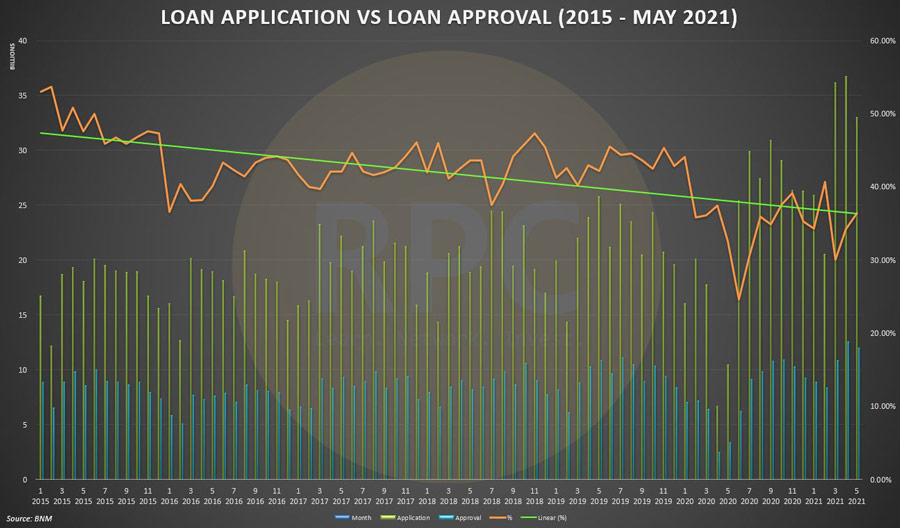

For this, we have to plot a graph to show mortgage application vs approval in percentage.

Though we could see the percentage of approval increased from March to May 2021, but it is still below the median approval rate of 42.88% for the period of 2015 - 2021. It is clear that there were more people apply for loan and got their applications rejected. And we are looking at more than 62% rejection rate. Without mortgage loan, the housing market would not recover anytime soon.

In my previous blog post - Start Investing Property in 2020 I mentioned that the property market is attractive as we get to enjoy discounted property price and low interest rates. But the reality is not as I’ve imagined. Even though there are many supply in the market leading to low property prices, but the problem is that we don’t financing from bank as easy as before. Thus, even if we really want to buy properties, it is at the mercy of the banks to give us financing. Yes, the interest rate is low currently but doesn’t mean everyone get to enjoy the low interest rates.

So what else I observed in Malaysia Property Market 2021?

In a recent report says property loan approval rates are expected to start recovering from the third quarter (Q3) of this year, as lockdown restrictions begin easing with the gradual opening of the economy. - The Star

I couldn’t see any foreseeable near future that the approval rate is going to improve with the current Covid-19 cases still on the rise. The same goes to property market as well. As at the beginning I already mentioned that property market relies on bank financing. Without significant improvement in approval rate, the property market will stay sluggish.

What I learned from the mortgage approval in first half of 2021 - The Focus is on the Primary Market by the Banks.

Many developers are reported that their sales increased Q2 this year.

Last month, Mah Sing Group Bhd announced that it is well-positioned to meet its 2021 target of RM1.6bil, having achieved property sales of approximately RM650.5mil for the first five months of the year as at end May, while locking in RM400mil for Q1 ended March 31, 2021.

The same month, Eco World Development Group Bhd announced that it had recorded RM1.32bil in sales in its Q2 ended April 30, 2021, nearly double the sales of RM706mil achieved during Q1 of its current financial year.

In a recent interview with StarBizWeek, IOI Properties Group Bhd group chief executive officer Datuk Voon Tin Yow said the company will meet, if not surpass, its sales target for the current financial year of more than RM2bil.

Earlier this week, Sunway Property announced that it is revising upwards its 2021 sales target to RM2.2bil from the RM1.6bil it had set in January this year, underpinned by the group’s strong performance in Singapore.

Based on recent headlines from developers, it made me think the recent approval rate increase majority are towards primary market. This is consistent with those on the ground processing loans and selling properties. They provided me with insights that only primary market is currently able to sell (able to get financing from the bank). The secondary market is going really slow.

The logic is simple, when the banks financing developers projects, the mortgage loans are slowly disbursed base on the progress of the constructions. Therefore the banks can reduce or perhaps control their risks better. The mortgage loans in secondary market are usually disburse within three to six months time.

Why is this matters?

If my assumption is correct, the market would not recover anytime soon if the banks continue to favour primary market more than secondary market. This is simple equation as majority of properties in the market are secondary! Primary market such as developer’s projects accounted only small fraction in whole property market in Malaysia.

Now when come to think of it, no wonder the market so slow!

How I See the Property Market Going Forward?

(Previously shared live on Facebook)