In most countries, real estate represents a significant portion of people’s wealth, an average person has at least one-third of his or her net worth tied up in real estate. The size and scale of the real estate market make an attractive and lucrative sector for many investors. Sky rocketing property prices remain a very common topic among fellow Malaysians for the past few years. But right now, times are bad, will property prices starts to fall or remain stagnant? That’s a big question mark for all of us. In this article, I will explore how does the economy affect the Malaysia housing market.

Nevertheless, let’s look at some of the factors affecting the property prices:

Interest Rates

Interest Rates have a major impact on real estate markets as changes in interest rates will affect a person’s ability to purchase property.

Unemployment

When unemployment rises (which is exactly what’s happening in Malaysia’s market right now, retrenchments from major financial institutions and MNCs companies), less people will be able to afford a house and worst case scenario, some even have problem paying their monthly mortgage repayments. Those who lose their job may end up with their home repossess. The fear of unemployment may discourage people from entering into property market.

Consumer confidence

Buyer’s confidence is important for determining whether people want to take the risk of investing hence expectations towards the housing market is important; if people fear that house prices could fall due to bad economic condition, then they will tend to have “Wait and See” mentality by deferring to buy a property.

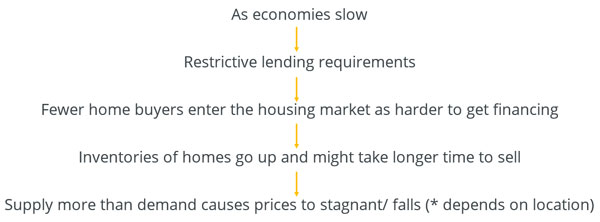

Mortgage availability

During the boom years, many banks were very keen to lend mortgages. The ease of getting a mortgage increases demand for properties hence affecting the property prices to rise due to strong demand. However, when times are bad, banks reacted the opposite way by tightening their lending criteria, which reduced the availability of mortgages. For those who do not have strong financial track record will probably face some issues in obtaining loans from banks.

Supply vs. Demand

In general, when supply greater than demand, property prices tends to be stagnant or even falls (this largely depends on the location) & vice versa. More attractive packages/ rebates will be available in the market when there is oversupply of properties. Real estate consultancy firm Knight Frank Malaysia foresees more high-end condominium projects in Kuala Lumpur that were originally scheduled for launch by 1H2016 being deferred owing to the large amount of incoming supply and poor market sentiment (source: TheEdge Property).

The Property

-

Location - Availability of shopping centres, shoplots and hypermarkets nearby definitely adds value to the premise.

-

Tenure - Freehold properties generally fetch higher price tag as compared to leasehold properties.

-

Infrastructure - Properties located near to bus station/ MRT/ LRT/ Monorails/ major highways will definitely influence the price of the property.

-

Future Development - Properties prices will go up in value if there is massive upcoming development in the area.

-

Security - With current economic condition and rising crime rates in Malaysia, any housing with added security becomes a necessity. A premium can be added to the housing price if the community is fully secured.

The Economy

Lastly, one main key factor that affects the value of real estate is the overall health of the economy (contributed by factors such as GDP, employment data, government policies & subsidies, prices of goods, petrol prices etc). In Malaysia right now, the economy is slowing and the ringgit is depreciating. Cost of living increases. House prices continue to rise, though at much slower pace. Property transactions and building construction activities are slowing down dramatically.

The Malaysian House Price Index increased by 5.4% in Q3 2015P relative to Q3 2014 according to JPPH.

Home sales are directly linked to the economy’s health. Demand for housing is dependent upon income. With higher economic growth and income, people will be able to spend more on houses; this will increase demand and subsequently push up prices.

So back to the common questions:

Is it still the right time to enter the property market?

My personal opinion is that property investment is a long term game. Everyone knows that property prices will generally increase over long run. So the important point right now is the “holding power”. To find out more about the Malaysia Property Cycle, click here

If you have some extra savings, do look out for good investment opportunities out there, be it:

Pre-launch projects - those that are located in good location with bright room for future capital appreciation/ rental returns (normally more rebates will be given by developer when the times are bad) so this is actually a good chance to grab some great deals provided you have done your full research in the area that you plan to invest in.

Sub-sale Properties - there will be many below market value properties available in the market as owner willing to sell at a lower price due to personal reasons such as retrenchment, migration, moving to a smaller house, debt repayments etc. Hence keep an eye on these deals and make sure you do your homework before investing. The annual appreciation of your property will be largely affected by the inflation rate, general demand, upcoming development, and the infrastructure surrounding the area. Get FREE training on how to look for good subsale property with rental.