This could be the only time that I experienced a pandemic. And I really hope that this is the last. A disease outbreak is not common at global scale. The most we have seen is regional such as SARS outbreak in 2002. When it comes to pandemic outbreak, I would say that most world leaders never seen it or experience first hand. Thus, this explains why we are having hard time to fight against the Covid-19 virus. In this article, I will explore how Covid-19 pandemic impact on property market in Malaysia.

The usual economic model such as market cycle, property cycle etc are all irrelevant when we have Covid-19 within the context. I would say the economic models are all fail due to unpredictability on how the virus behave. The minute we see a little of improvement in economic cycle, then the next is another Covid-19 positive cluster detected. With ongoing Covid-19 cases, the recovery for any economy is rather difficult.

I’m not sure if this is a good news or bad news. The bad news is that property market will definitely take much longer to recover. The good news is that we are not alone. Malaysia property market is not the only market affected by Covid-19. Due to globalisation, almost all economies are linked and affected by the virus outbreak.

Malaysia property market depends on two major markets. The first is foreign market. When the Covid-19 outbreak, the most logical way to control the spread of the virus is to close the Malaysian border. That also means we are closing doors to foreign investors to come to invest in Malaysia’s property. With the closure of Malaysian border, what left is domestic market.

The question to ask is whether domestic market is able to consume the product (property) in the market?

For this, we have to look into the socioeconomic status for Malaysians. There are three main groups which is T20, M40 and B40. Specifically, we are looking at income level of each group. The table below shows income level of each group.

| Income Group | Tier 1 | Tier 2 | Tier 3 | Tier 4 |

|---|---|---|---|---|

| T20 | RM10,961 - RM15-039 | >RM15,040 | - | - |

| M40 | RM4,850 - RM5,879 | RM5,880 - RM7,099 | RM7,110 - RM8,669 | RM8,700 - RM10,959 |

| B40 | <RM2,500 | RM2,501 - RM3,169 | RM3,170 - RM3,969 | RM3,970 - RM4,849 |

From the table above, T20 are mostly those ‘C’ level or business owner. With that income, T20 can afford to buy or invest properties above RM1 Million threshold. However when we look at the majority of the population are less likely to be able to afford properties for RM1 Million above. Thus, luxury and high end category properties will be those that affected the most as only small percentage of population can afford to buy. The high end category property affected even more when access to foreign markets are blocked due to border closure.

B40 income group is less likely to be able to buy properties in any category due to limited disposable income.

So, what is left in the domestic market?

M40 income group is the most potential group that could consume the supply in the market. But this group has its own problems. Within this group, those that would buy property is either home buyers or investors. Because of Covid-19 impact on businesses on top levels, many companies either cutting down on salary or laying off their employees. Those initially wanted to buy property became more cautious by postponing their home purchase. Instead of buying, they rent first.

While for investors, as the market is so volatile and ambiguous, they tend to invest their money in stock market. Simply because stocks provide liquidity. At uncertain times, people either reserve cash or invest in investment vehicle that provides high liquidity.

See also What to Invest with 10k in Malaysia

Problems with Loan

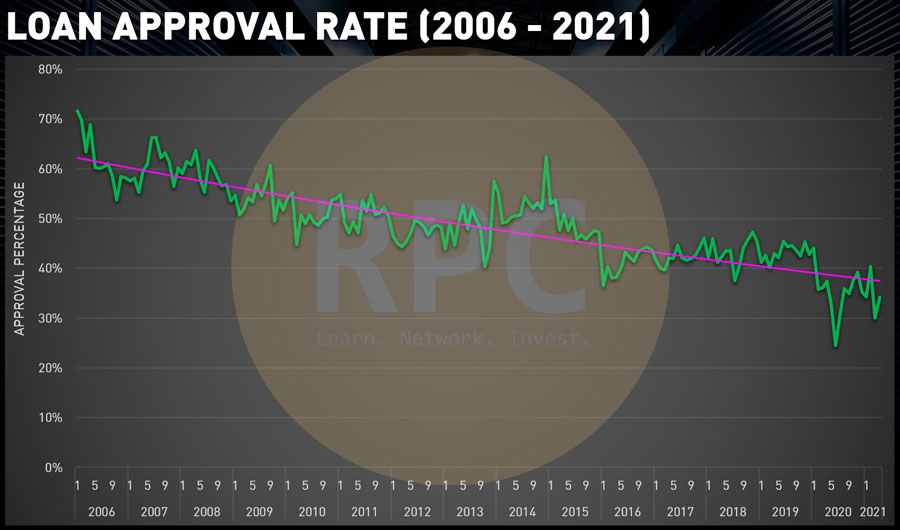

Leverage on bank in property investment is not something unusual. Those in M40 income group that prefer to invest in property face another challenge. It is no doubt that this is the best time to invest in property. With supply more than demand plus interest rate at the lowest since 1997. It is no brainer not to invest in property now. But the problem is that getting loan approved is not as easy as before. The graph below shows approval rate of more than 65% back in 2006, while in 2021 the approval rate is below 40%.

What is this telling us? It means 100 people submitted loan application to the bank, only 40 people get their loans approved.

Covid-19 Pandemic Impact on Property Market is Certainly a Huge One!

With border closure preventing foreigners to invest, T20 income group not buying high end property due to low ROI, M40 income group being cautious and banks not approving loan (like before) subsequently dampened the Malaysia’s property market even more. Market sentiment is low and the supply is definitely more than demand now.

What to Expect Going Forward?

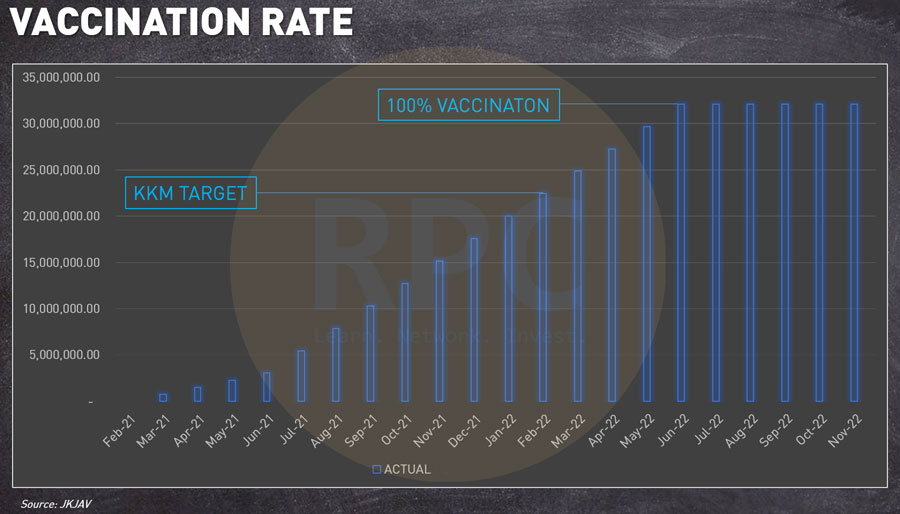

Since all economic models fail to predict or forecast where the markets are leading to, the only thing we can rely on is how soon everything will back to normal? For this, we have to look into the national vaccination rate. The Three Phases Vaccination plan works as reported below:

The first phase, which will involve frontline staff, will take place from Feb 26 until April. This is expected to encompass around 500,000 people. The second phase, which involves high risk groups such as the elderly and those suffering from chronic conditions, is slated for April until August. This is set to include around 9.4 million people.

Meanwhile, the third phase, for adults aged 18 and above, will take place from May until February 2022. This is set to include at least 13.7 million people - Source CNA

At the time of writing this article, the information from Jawatankuasa Khas Jaminan Akses Bekalan Vaksin JKJAV indicated between 13 June 2021 and 20 June 2021, there were 1,070,297 vaccination done to total vaccinated at 4,202,601. Based on the vaccination rate, it seems the Malaysian government is able to hit the target of 23.6M people vaccinated by February 2022.

The graph below shows vaccination rate and projection of 100% vaccination from March 2022 onwards. This is provided vaccines supply is not interrupted.

Now we know how covid-19 pandemic impact on property market, the next question is:

When will property market recover?

If the Malaysia government managed to vaccinate 100% of the population by June, then the border will likely to open in July or August 2022. From there, the property market will see sign of recovery by February 2023 (earliest). Reason is because;

-

Border re-opened means tourism related businesses will recover;

-

After election, government will draw out many recovery plans. Means more projects will be introduced;

-

More jobs being created. Banks start lending but only to those with good profile. Those previously unemployed and subsequently get new job will need to build profile slowly including those from tourism industry.

-

When everything checks and money flowing into the market, then people will start to buy or invest in property again. Which leads to property boom.

Of course, the government can choose to open the border even before 100% vaccination is achieved. If that were to happened, then recovery will be sooner. It is expected that property boom market will follow suit from the above. I am anticipating the boom in Malaysia property market to be in mid 2024 to 2025.